Nigeria ended 2025 averaging 1.63-1.66 million barrels per day (mbpd) of crude oil and condensate — an 18% recovery from the 2022–2023 lows but still 25–30% below its historical OPEC quota range (approximately 2.0 mbpd) and well short of the 2025 budget benchmark of 2.06 mbpd. December 2025 saw crude output slip to 1.42 mbpd (down from approximately 1.59-1.60 mbpd in November), according to direct reports to OPEC, while secondary estimates pegged it at around 1.5 mbpd reflecting late-year volatility.

The Wins

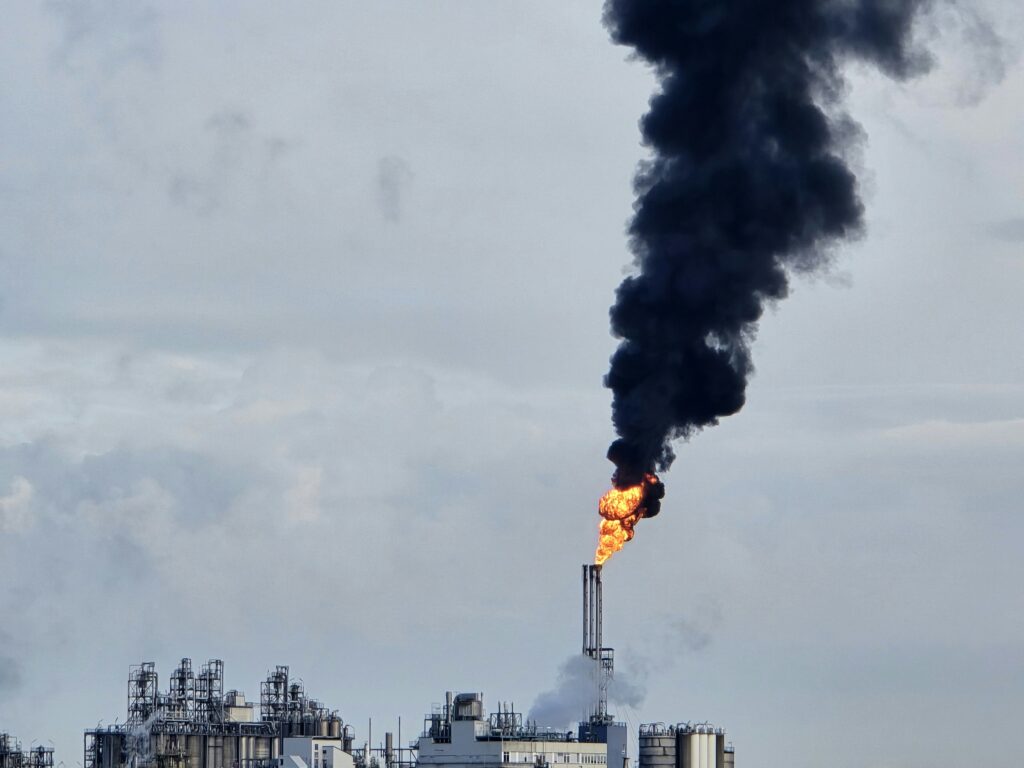

Three factors delivered real gains: Improved pipeline security reduced theft and allowed surges in key Niger Delta fields (>335,000 bpd at times), Brownfield optimization through “Project One Million Barrels” from mature fields, and Indigenous operators and early PIA benefits lifted the full-year average.

The Misses

From an OPEC perspective, Nigeria broadly aligned with its managed output framework through much of 2025. Domestically, however, production continued to trail budget benchmarks, limiting fiscal upside despite supportive oil prices. Volatility remains as costly as underproduction, complicating revenue planning. The sharp drop from October’s peak (1.75 mbpd) to December (1.42 mbpd) could signal temporary maintenance shutdowns or structural constraints reasserting.

Also, Revenue shortfalls from missing budget targets strained public finances.

Realistic Forecasts for 2026:

Government ambitions for 2026 are bold, a budget benchmark of 1.8–1.84 mbpd, escalating to 2 mbpd by 2027 and 3 mbpd by 2030 under NUPRC’s new three-pillar agenda (efficiency, certainty, sustainability). The government’s 2+ mbpd production ambition reflects Nigeria’s long-term geological potential, but near-term deliverability remains uncertain. Based on current trends, a base-case outlook of 1.7–1.8 mbpd for 2026 appears more realistic. Reaching and sustaining production above 2 mbpd would require a step-change: accelerated investment in evacuation infrastructure, faster project approvals, and a durable reduction in operational risk.

Recommendations for Stakeholders

- Prioritize Security Investments

- For energy firms, bid strategically in the 2025 round focusing on shallow-water and gas plays with low bonuses for quick wins.

- Track Brent prices ($55–75/bbl range) and OPEC+ decisions conclusion

Nigeria’s 2025 performance represents real but insufficient progress. Fiscal reforms and security improvements stabilized production, but structural constraints, aging infrastructure, limited drilling, persistent theft create a ceiling around 1.7-1.8 mbpd without comprehensive interventions. For 2026, modest growth towards approximately 1.72mbpd is likely, rather than a transformational leap to 2.0+ mbpd.